Emissions Trading Systems: An In-Depth Explanation

Meta Description

Emissions trading systems (ETS) are market-based tools used to control pollution by providing economic incentives for reducing emissions. This comprehensive guide delves into the intricacies of ETS, exploring their purpose, implementation, effectiveness, and potential solutions to address climate change.

Meta Keywords

Emissions trading systems, cap-and-trade, carbon pricing, environmental policy, climate change mitigation

1. Introduction

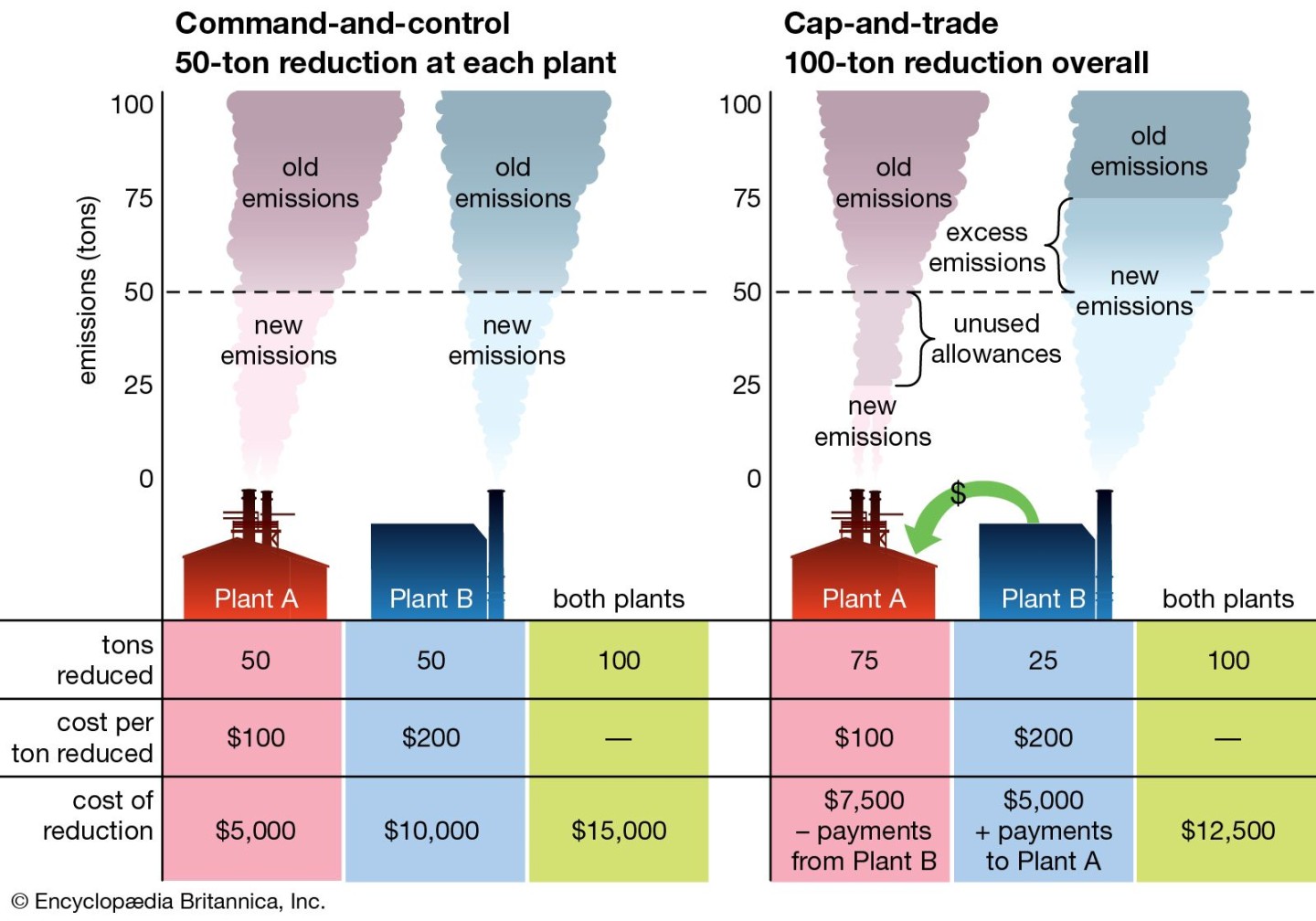

The escalating threat of climate change has propelled the need for effective strategies to curb greenhouse gas (GHG) emissions. Emissions trading systems (ETS) have emerged as a prominent market-based approach to achieving environmental goals. ETS operate on the principle of cap-and-trade, establishing a maximum limit (cap) on permissible emissions within a defined area or sector. Within this cap, tradable allowances or permits are issued to polluters, allowing them to emit a specific amount of GHGs.

1.1 Purpose of Emissions Trading Systems

The primary objective of ETS is to reduce overall emissions in a cost-effective manner. By setting a cap on emissions, ETS create a scarcity of emission allowances, driving up their price. This economic incentive encourages polluters to adopt cleaner technologies and production processes to minimize their emissions and reduce the cost of compliance.

1.2 Key Characteristics of Emissions Trading Systems

ETS are characterized by several key elements:

1. Cap: A predetermined maximum limit on total emissions within a specific scope.

2. Allowances: Tradable permits issued to polluters, representing the right to emit a specified quantity of GHGs.

3. Compliance: Polluters must surrender allowances equivalent to their actual emissions by the end of the compliance period.

4. Trading Platform: A regulated marketplace where allowances can be bought and sold among polluters.

1.3 Types of Emissions Trading Systems

Emissions trading systems can be broadly classified into two main categories:

1. Cap-and-Trade: The most common type, where allowances are issued and traded within a fixed emissions cap.

2. Baseline-and-Credit: In this system, no explicit cap is set, but polluters that reduce emissions below their baseline can generate credits, which can be sold to those who exceed their baseline.

2. Implementation of Emissions Trading Systems

The successful implementation of ETS requires careful consideration of several critical factors:

1. Scope and Coverage: Clearly defining the sectors, pollutants, and geographical boundaries covered by the ETS.

2. Cap Setting: Determining an ambitious yet achievable emissions cap, aligning with overall environmental goals.

3. Allowance Allocation: Deciding the method for distributing allowances, such as auctioning, grandfathering, or a combination of both.

4. Monitoring and Reporting: Establishing robust mechanisms for monitoring and verifying emissions data from polluters.

5. Enforcement: Implementing effective enforcement measures to ensure compliance and deter non-compliance.

3. Effectiveness of Emissions Trading Systems

Emissions trading systems have demonstrated their effectiveness in reducing emissions in various contexts:

1. The European Union Emissions Trading System (EU ETS): The world’s largest ETS, the EU ETS has successfully reduced emissions covered under the scheme by over 40% since its inception in 2005.

2. The Regional Greenhouse Gas Initiative (RGGI) in the United States: RGGI, a cap-and-trade program in the Northeast US, has achieved significant emission reductions for sulfur dioxide and is now exploring carbon dioxide pricing.

3. The New Zealand Emissions Trading Scheme (NZ ETS): The NZ ETS has been effective in reducing overall emissions and has played a crucial role in New Zealand’s efforts to meet its international climate commitments.

4. Challenges and Solutions for Emissions Trading Systems

Despite their proven effectiveness, ETS face several challenges that need to be addressed to ensure their long-term success:

1. Market Power and Price Volatility: The concentration of allowances in the hands of a few polluters can lead to market power and price volatility, potentially undermining the efficiency of the system.

2. Carbon Leakage: The risk of emissions shifting to regions without ETS, known as carbon leakage, can hinder the overall effectiveness of the system.

3. Integration with Other Climate Policies: Effectively integrating ETS with other climate policies, such as technology mandates and carbon taxes, can enhance their overall impact.

4. Addressing Equity Concerns: Ensuring a fair and equitable distribution of allowances and burdens is crucial to gain public acceptance and address distributional impacts.

5. The Role of Emissions Trading Systems in Addressing Climate Change

Emissions trading systems play a significant role in addressing climate change by:

1. Establishing a Price on Carbon: ETS put a price on carbon, creating a financial incentive for polluters to reduce emissions and driving innovation in low-carbon technologies.

2. Market-Based Approach: ETS leverage market forces to achieve