Capital Asset Pricing Model (CAPM)

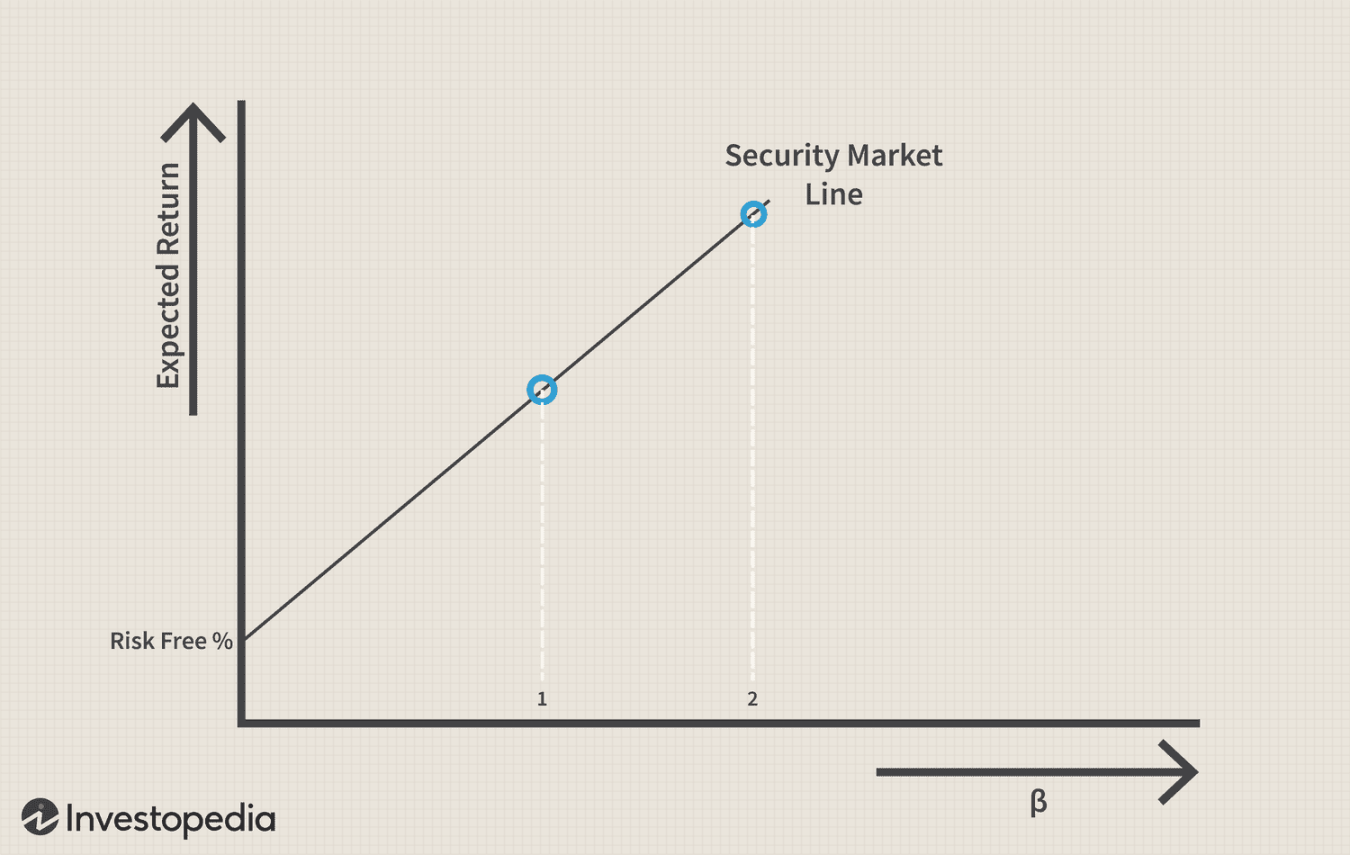

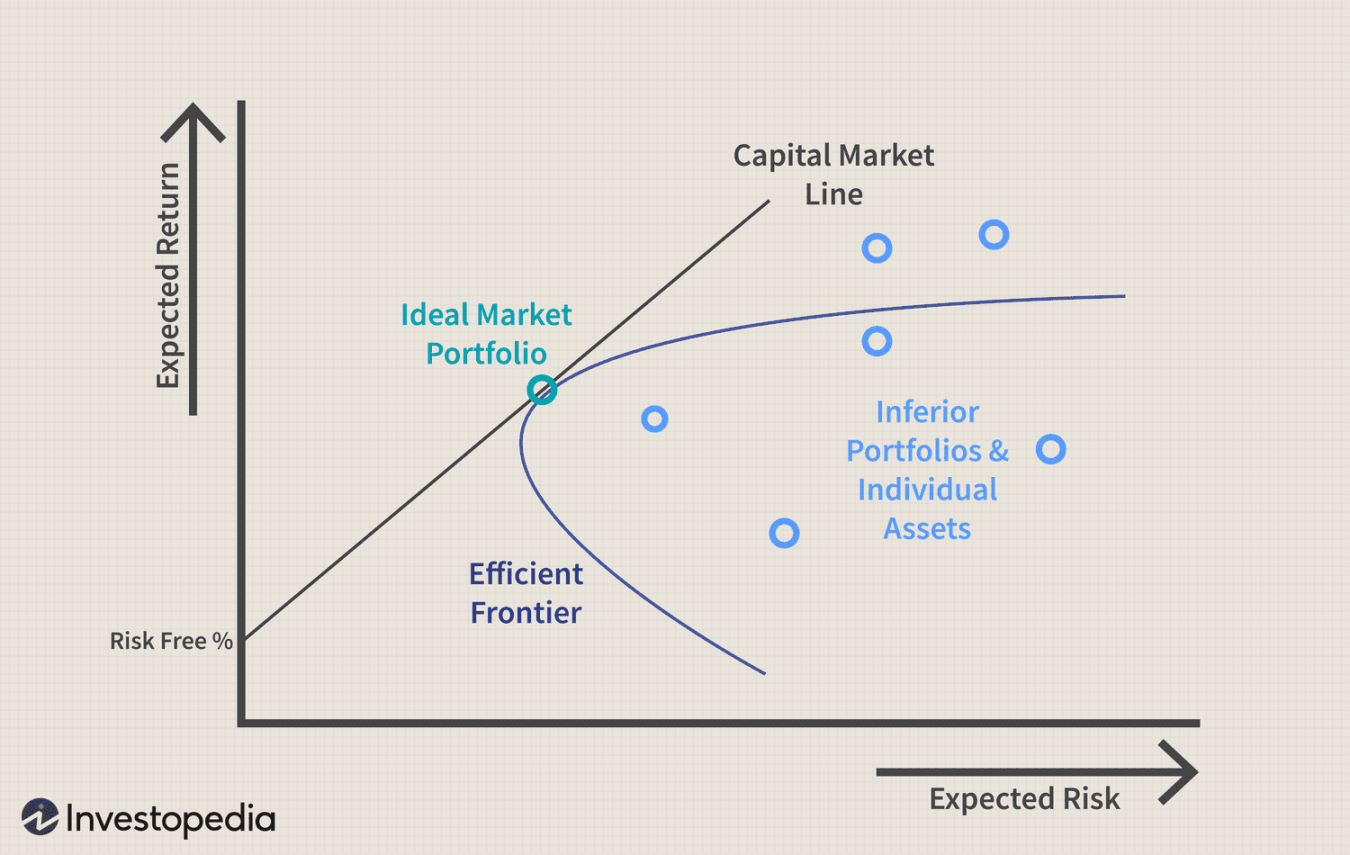

The Capital Asset Pricing Model (CAPM) is a mathematical model that calculates the expected return on an investment based on its systematic risk (beta). Systematic risk, also known as market risk, is the risk that an investment cannot be eliminated through diversification. The CAPM is widely used in finance to estimate the cost of capital for companies and to make investment decisions.

The CAPM is based on the idea that investors should be compensated for taking on risk. The more systematic risk an investment has, the higher its expected return should be. The CAPM formula is as follows:

“`

Expected return = Rf + Beta (Rm – Rf)

“`

Where:

Rf is the risk-free rate of return

The risk-free rate is the rate of return that investors can expect to earn on an investment that has no risk. The risk-free rate is typically considered to be the yield on government bonds.

Beta is a measure of an investment’s systematic risk. Beta is calculated by comparing the investment’s return to the return on the market. A beta of 1 means that the investment’s return moves in line with the market. A beta of more than 1 means that the investment’s return is more volatile than the market, and a beta of less than 1 means that the investment’s return is less volatile than the market.

The expected return on the market is the average return that investors expect to earn on all investments in the market. The expected return on the market is typically estimated using a historical average of market returns.

The CAPM tells us that investors should expect to earn a higher return on investments with more systematic risk. This is because investors are compensated for taking on risk. The CAPM can also be used to estimate the cost of capital for companies. The cost of capital is the rate of return that a company must earn on its investments in order to satisfy its shareholders.

The CAPM is a simple and widely used model, but it has some limitations. One limitation is that the CAPM assumes that investors are rational and that they have full information about investments. This is not always the case. Another limitation is that the CAPM assumes that markets are efficient. This means that the prices of investments reflect all available information. This is also not always the case.

Despite its limitations, the CAPM is a valuable tool for investors and financial analysts. The CAPM can be used to:

Estimate the expected return on an investment

The Capital Asset Pricing Model (CAPM) is a mathematical model that calculates the expected return on an investment based on its systematic risk (beta). The CAPM is widely used in finance to estimate the cost of capital for companies and to make investment decisions. The CAPM is a simple and useful model, but it has some limitations. Investors and financial analysts should be aware of these limitations when using the CAPM.

1. What is the difference between systematic risk and unsystematic risk?

Systematic risk, also known as market risk, is the risk that an investment cannot be eliminated through diversification. Unsystematic risk, also known as specific risk, is the risk that an investment can be eliminated through diversification.

2. How is beta calculated?

Beta is calculated by comparing the investment’s return to the return on the market. A beta of 1 means that the investment’s return moves in line with the market. A beta of more than 1 means that the investment’s return is more volatile than the market, and a beta of less than 1 means that the investment’s return is less volatile than the market.

3. What is the risk-free rate of return?

The risk-free rate of return is the rate of return that investors can expect to earn on an investment that has no risk. The risk-free rate is typically considered to be the yield on government bonds.

4. What is the expected return on the market?

The expected return on the market is the average return that investors expect to earn on all investments in the market. The expected return on the market is typically estimated using a historical average of market returns.

5. What is the cost of capital?

The cost of capital is the rate of return that a company must earn on its investments in order to satisfy its shareholders.