Peer-to-Peer Lending Networks: A Comprehensive Guide

Introduction

In the dynamic realm of finance, peer-to-peer (P2P) lending networks have emerged as a transformative force, revolutionizing the way individuals and businesses access and utilize capital. Bypassing traditional banking institutions, P2P platforms connect borrowers directly with lenders, facilitating a streamlined and often more efficient lending process. This article delves into the intricacies of P2P lending networks, shedding light on their mechanisms, advantages, and potential risks.

Understanding the Essence of P2P Lending Networks

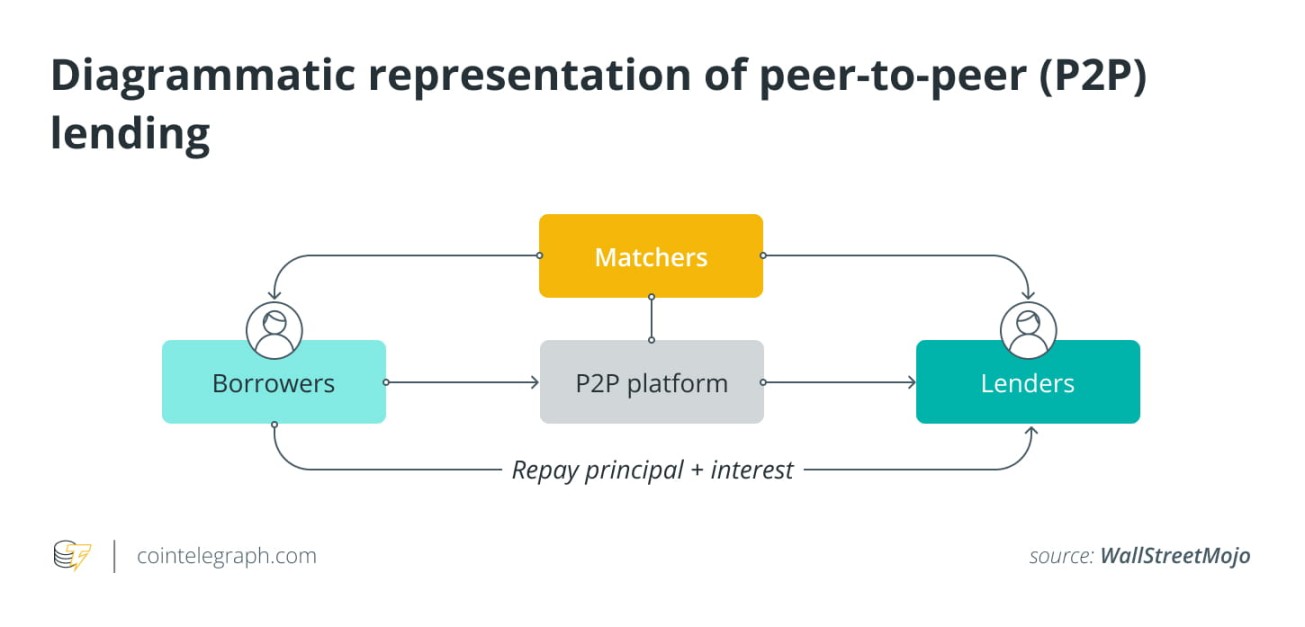

At their core, P2P lending networks operate as online marketplaces, bridging the gap between borrowers seeking funds and investors willing to lend. These platforms leverage technology to streamline the lending process, eliminating the intermediaries that typically characterize traditional banking channels.

1. Direct Connection: Borrowers and lenders interact directly, eliminating the need for bank involvement.

2. Technology-Driven: Online platforms facilitate efficient matchmaking and transaction processing.

3. Diverse Lending Options: Borrowers can access a wider range of loan types and interest rates.

4. Potential for Higher Returns: Investors may earn competitive returns on their investments.

The Mechanics of P2P Lending: A Step-by-Step Guide

1. Borrower Registration: Borrowers create an account, providing personal and financial information.

2. Loan Creation: Borrowers list their loan requests, specifying the amount, purpose, and repayment terms.

3. Lender Assessment: Lenders review loan requests and invest in those that align with their risk appetite.

4. Funding and Disbursement: Upon reaching the funding target, the loan is disbursed to the borrower.

5. Repayment Schedule: Borrowers make regular repayments, including principal and interest, to lenders.

Unveiling the Advantages of P2P Lending Networks

1. Accessibility: P2P lending expands access to capital for borrowers with limited traditional financing options.

2. Competitive Rates: Borrowers may benefit from lower interest rates compared to traditional loans.

3. Flexible Terms: Loan terms can be tailored to the specific needs of both borrowers and lenders.

4. Potential for Higher Returns: Investors may earn attractive returns on their investments.

5. Transparency and Efficiency: Online platforms promote transparency and streamline the lending process.

Navigating the Potential Risks of P2P Lending

1. Credit Risk: Lenders face the risk of borrowers defaulting on their loan repayments.

2. Interest Rate Fluctuations: Interest rates may fluctuate, impacting both borrower and lender returns.

3. Platform Risk: The stability and reliability of the P2P lending platform are crucial.

4. Regulatory Landscape: P2P lending is subject to evolving regulations that may impact operations.

5. Fraudulent Activities: The potential for fraudulent activities exists on both sides of the platform.

Strategies for Informed Decision-Making in P2P Lending

1. Conduct Thorough Research: Evaluate the reputation and track record of the P2P lending platform.

2. Assess Creditworthiness: Carefully analyze borrowers’ credit history and financial standing.

3. Diversify Investments: Spread investments across multiple loans to mitigate risk.

4. Understand Fees and Charges: Be aware of associated fees and their impact on returns.

5. Stay Informed: Keep abreast of market trends, regulatory changes, and platform updates.

Expanding the Scope of P2P Lending: Diverse Applications

1. Business Loans: P2P platforms facilitate funding for small businesses and startups.

2. Consumer Loans: Personal loans, student loans, and auto loans are commonly offered.

3. Real Estate Loans: Financing for property purchases and renovations is available.

4. Invoice Financing: Businesses can access funds based on outstanding invoices.

5. Agricultural Loans: P2P lending supports the agriculture sector with financing options.

The Future of P2P Lending: Embracing Innovation and Growth

As technology advances and financial regulations evolve, P2P lending networks are poised for continued growth and innovation. Enhanced risk assessment tools, data analytics, and artificial intelligence are expected to play a significant role in shaping the future of P2P lending.

Conclusion

Peer-to-peer lending networks have revolutionized the financial landscape, offering borrowers and lenders alternative