Infrastructure Investment Trusts (InvITs): A Comprehensive Guide

Introduction

In the realm of infrastructure development, Infrastructure Investment Trusts (InvITs) have emerged as a significant financial instrument, channeling investments from a broad range of individuals and institutions into critical infrastructure projects. This comprehensive guide delves into the intricacies of InvITs, exploring their concept, structure, operational framework, and the potential advantages they offer to investors.

Understanding InvITs: Definition and Purpose

Infrastructure Investment Trusts (InvITs) are essentially collective investment schemes that pool funds from investors to invest in a portfolio of income-generating infrastructure assets. These assets typically encompass a diverse range of projects, including roads, highways, power plants, transmission lines, ports, airports, and telecommunications towers.

The primary objective of InvITs lies in facilitating the development of India’s infrastructure sector by attracting investments from a wider pool of participants. By enabling direct investment in infrastructure projects, InvITs aim to broaden the investor base beyond traditional institutional investors, thereby fostering inclusive economic growth.

Structure and Regulatory Framework of InvITs

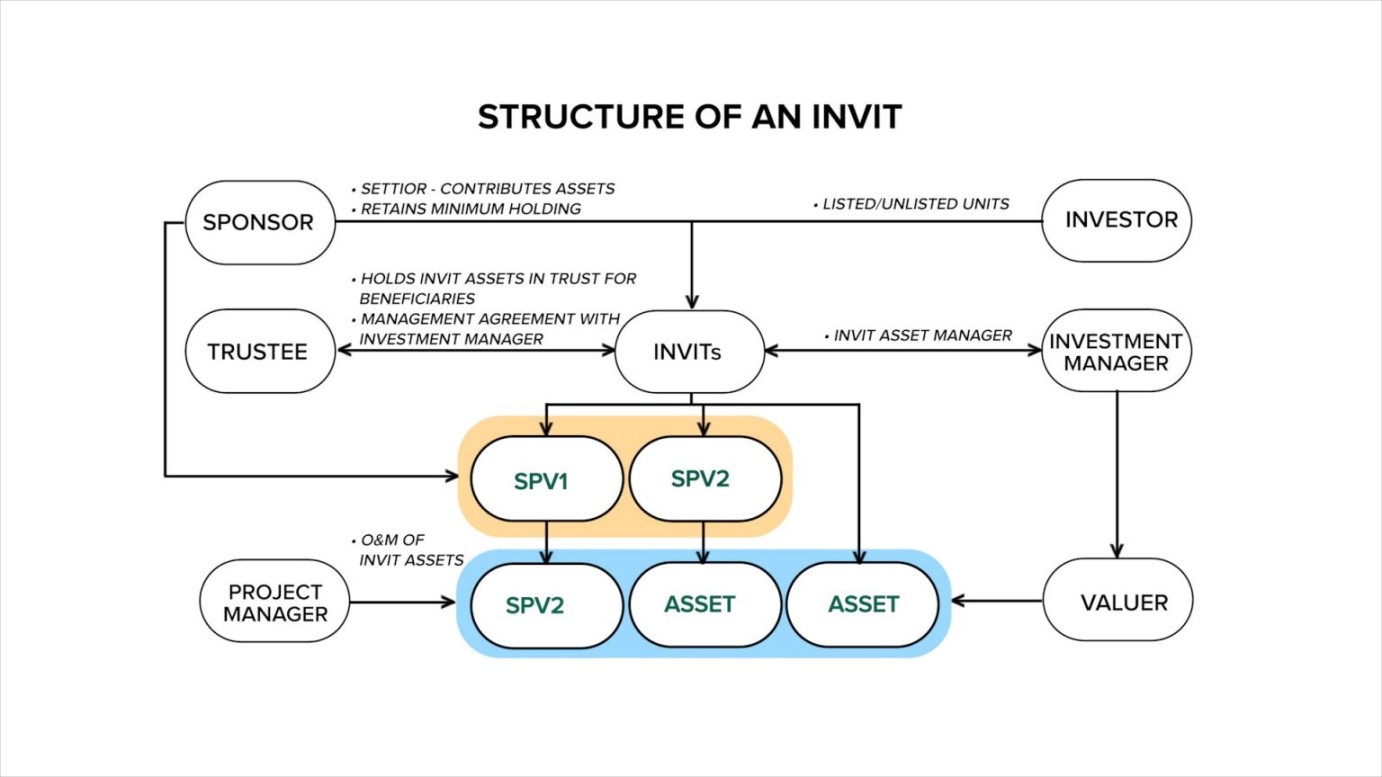

InvITs are structured as trusts, governed by the SEBI (Infrastructure Investment Trusts) Regulations, 2014. These regulations outline the operational framework, investment guidelines, and distribution requirements for InvITs.

1. Trustee: The trustee oversees the overall management and administration of the InvIT, ensuring compliance with regulatory requirements and protecting the interests of unitholders.

2. Sponsor: The sponsor, typically an infrastructure developer or project management company, establishes the InvIT and contributes the initial infrastructure assets.

3. Investment Manager: The investment manager is responsible for identifying, evaluating, and selecting infrastructure projects for the InvIT’s portfolio.

4. Project Manager: The project manager oversees the operation and maintenance of the infrastructure assets, ensuring their efficient functioning and revenue generation.

Investment Process and Returns in InvITs

Investors in InvITs acquire units of the trust, representing a fractional ownership interest in the underlying infrastructure assets. The investment process typically involves:

1. Issue of Units: The InvIT raises capital by issuing units to investors through an initial public offer (IPO) or subsequent offers.

2. Investment in Infrastructure Assets: The proceeds from the issue of units are utilized to invest in a portfolio of income-generating infrastructure assets.

3. Distribution of Income: InvITs are mandated to distribute a significant portion of their distributable income to unitholders, primarily in the form of dividends.

Advantages of Investing in InvITs

Investing in InvITs offers several potential benefits to investors:

1. Access to Infrastructure Assets: InvITs provide investors with an opportunity to gain exposure to a diversified portfolio of infrastructure assets, which are traditionally illiquid and inaccessible to individual investors.

2. Regular Income Stream: InvITs are structured to generate regular and predictable income from the underlying infrastructure assets, offering a steady stream of returns for investors.

3. Capital Appreciation Potential: Over time, the value of InvITs may appreciate due to factors such as increased infrastructure demand, asset value growth, and potential tax benefits.

4. Portfolio Diversification: InvITs can serve as a valuable tool for portfolio diversification, as their returns are often less correlated with traditional asset classes like equities and bonds.

Taxation of InvITs

The taxation of InvITs is governed by the Income Tax Act, 1961. InvITs are treated as pass-through entities, meaning that the income generated at the InvIT level is not subject to corporate tax. Instead, the income is distributed to unitholders, who are taxed on their respective share of the distributed income at their applicable tax rates.

Risks Associated with InvITs

As with any investment, InvITs carry certain inherent risks that investors should carefully consider:

1. Project Risks: The performance of InvITs is closely linked to the performance of the underlying infrastructure projects. Delays, cost overruns, or operational issues in these projects can adversely impact the InvIT’s income and returns.

2. Interest Rate Risk: InvITs may be susceptible to interest rate risk, as their debt financing costs could increase in a rising interest rate environment.

3. Regulatory Changes: Changes in regulatory policies or tax laws could impact the operational framework and profitability of InvITs.

4. Liquidity Risk: InvIT units may not be as liquid as traditional equity or debt securities, making it difficult for investors to sell their units quickly at fair market value.