Hedge Fund Strategies: A Comprehensive Guide

Introduction

Hedge funds have emerged as prominent players in the financial landscape, attracting investors seeking high returns and diversification opportunities. These sophisticated investment vehicles employ a diverse range of strategies to navigate market conditions and generate profits. Understanding hedge fund strategies is crucial for investors seeking to evaluate their suitability and potential risks.

Defining Hedge Fund Strategies

Hedge fund strategies encompass a broad spectrum of investment approaches employed by hedge fund managers to achieve their objectives. These strategies often deviate from traditional investment methods, aiming to exploit market inefficiencies, generate returns regardless of market direction, or hedge against potential losses.

Common Hedge Fund Strategies

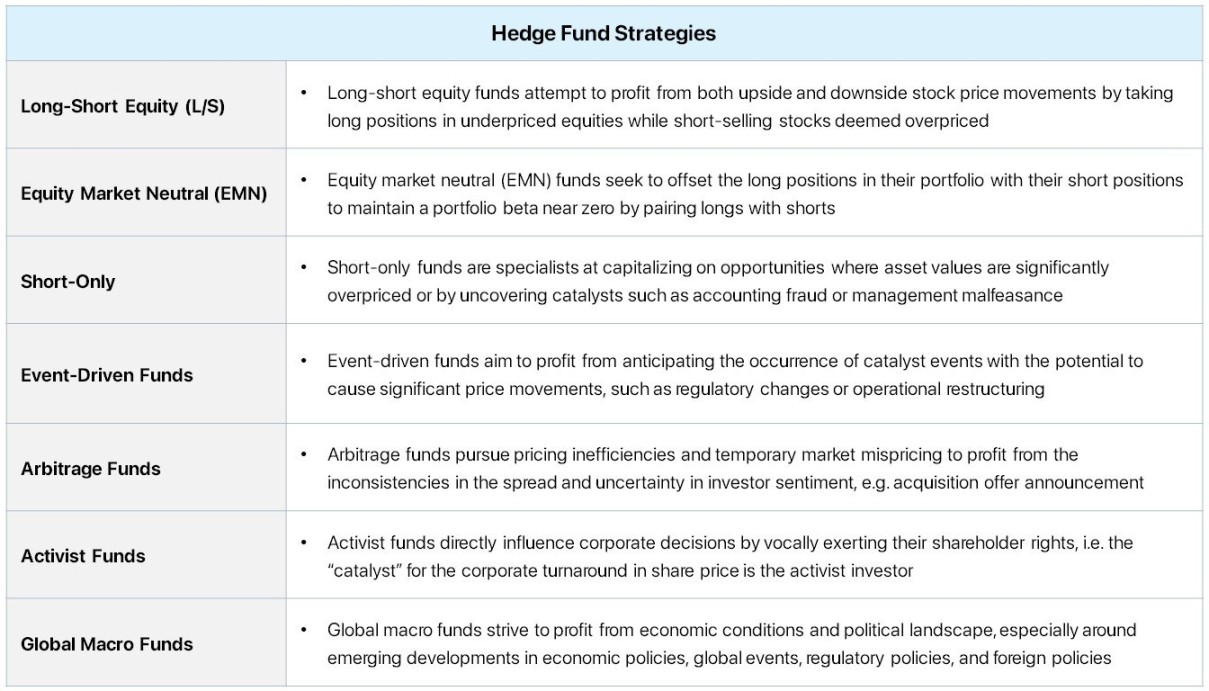

The diverse array of hedge fund strategies can be broadly categorized into several main approaches:

1. Equity Strategies: These strategies focus on investing in stocks, utilizing techniques such as long-only investing, short selling, and value investing to capitalize on stock price movements.

2. Fixed Income Strategies: Fixed income strategies involve investing in bonds and other debt instruments, employing tactics like buy-and-hold, arbitrage, and distressed debt investing to generate returns from interest payments and price fluctuations.

3. Macro Strategies: Macro strategies seek to profit from broad economic trends and geopolitical events, using instruments like currencies, futures, and options to bet on the direction of interest rates, exchange rates, and commodity prices.

4. Event-Driven Strategies: Event-driven strategies capitalize on specific corporate events, such as mergers, acquisitions, bankruptcies, and restructurings, by taking positions in the affected companies’ securities.

5. Multi-Strategy Hedge Funds: These hedge funds employ a combination of the aforementioned strategies, diversifying their portfolios and potentially mitigating risks while pursuing various return streams.

Understanding the Implementation of Hedge Fund Strategies

The implementation of hedge fund strategies involves a meticulous process that encompasses several key steps:

1. Research and Analysis: Hedge fund managers conduct in-depth research and analysis of market conditions, economic trends, and individual companies or assets to identify potential investment opportunities.

2. Portfolio Construction: Based on their research and analysis, hedge fund managers construct portfolios that align with their investment objectives and risk tolerance. They carefully select assets and allocate capital across different asset classes and strategies.

3. Risk Management: Risk management is paramount in hedge fund strategies. Managers employ various techniques, such as hedging, diversification, and position sizing, to mitigate potential losses and protect investors’ capital.

4. Performance Monitoring: Hedge fund managers continuously monitor the performance of their portfolios, tracking investments against benchmarks and making adjustments as market conditions evolve.

Information and Resources for Hedge Fund Strategies

Investors seeking to explore hedge fund strategies can access a wealth of information and resources:

1. Hedge Fund Research Firms: Reputable hedge fund research firms provide in-depth analysis, performance data, and risk assessments of hedge funds and their strategies.

2. Investment Publications and Websites: Industry publications and websites offer news, insights, and educational resources on hedge fund strategies and the overall hedge fund industry.

3. Regulatory Filings: Hedge funds are required to file periodic disclosures with regulatory bodies, providing investors with information on their strategies, investments, and performance.

Conclusion

Hedge fund strategies offer a diverse and complex landscape of investment approaches, potentially generating attractive returns for investors with a high-risk tolerance. However, understanding the intricacies of these strategies, their associated risks, and the due diligence process is essential before making any investment decisions.

FAQs

Hedge fund strategies can offer several potential advantages, including:

Hedge fund strategies are not without risks, which investors should carefully consider:

Hedge fund regulation varies across jurisdictions, but generally, they are subject to some level of oversight