Coincident Economic Indicators: Memahami Kondisi Ekonomi Saat Ini

Coincident Economic Indicators: A Window into the Current State of the Economy

In the realm of economics, understanding the pulse of the economy is paramount for informed decision-making by businesses, policymakers, and individuals alike. Coincident economic indicators serve as a valuable tool in this endeavor, providing real-time insights into the prevailing economic conditions. This comprehensive guide delves into the intricacies of coincident indicators, exploring their definition, significance, commonly used metrics, limitations, and practical applications.

Unveiling Coincident Economic Indicators: A Definition

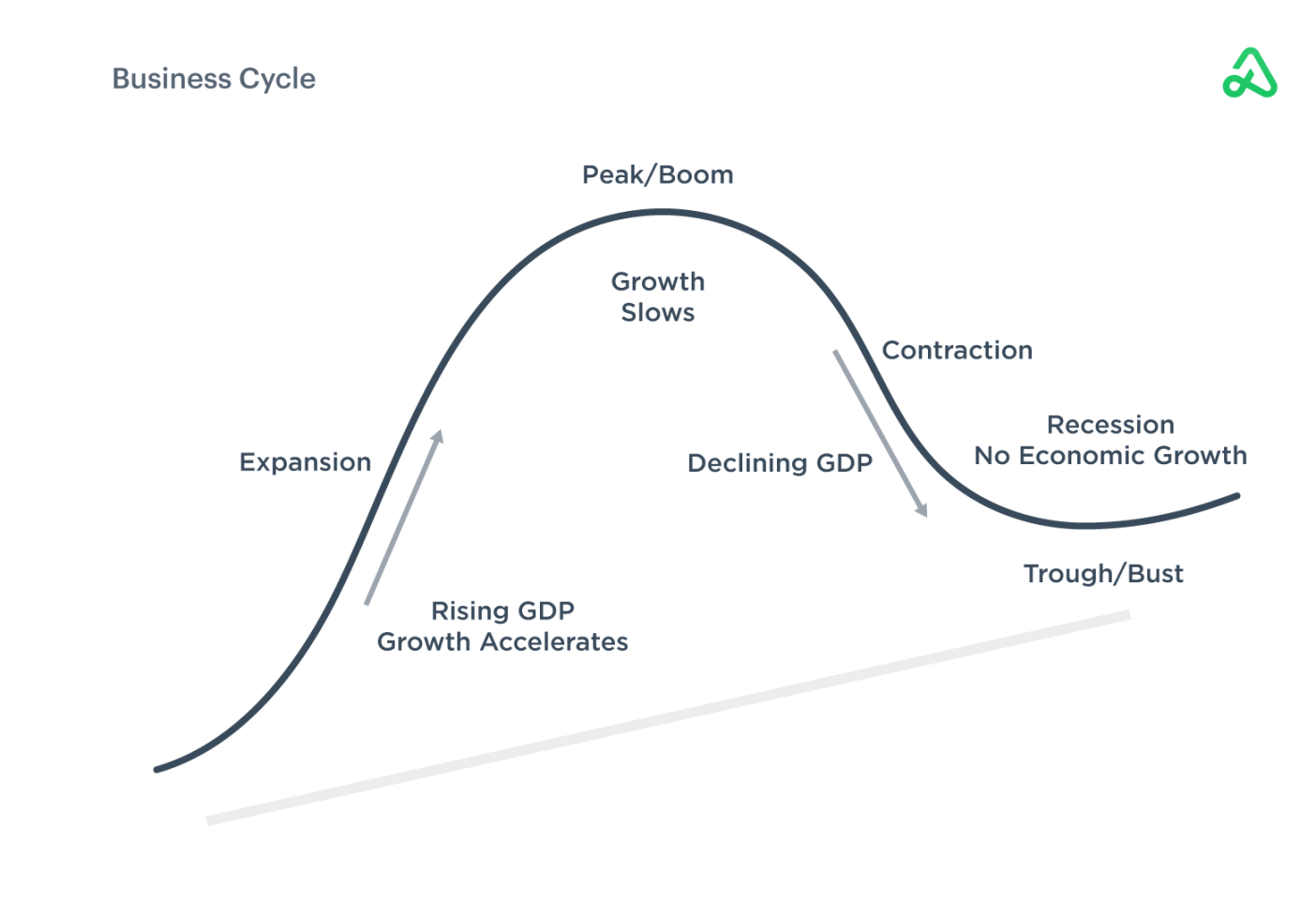

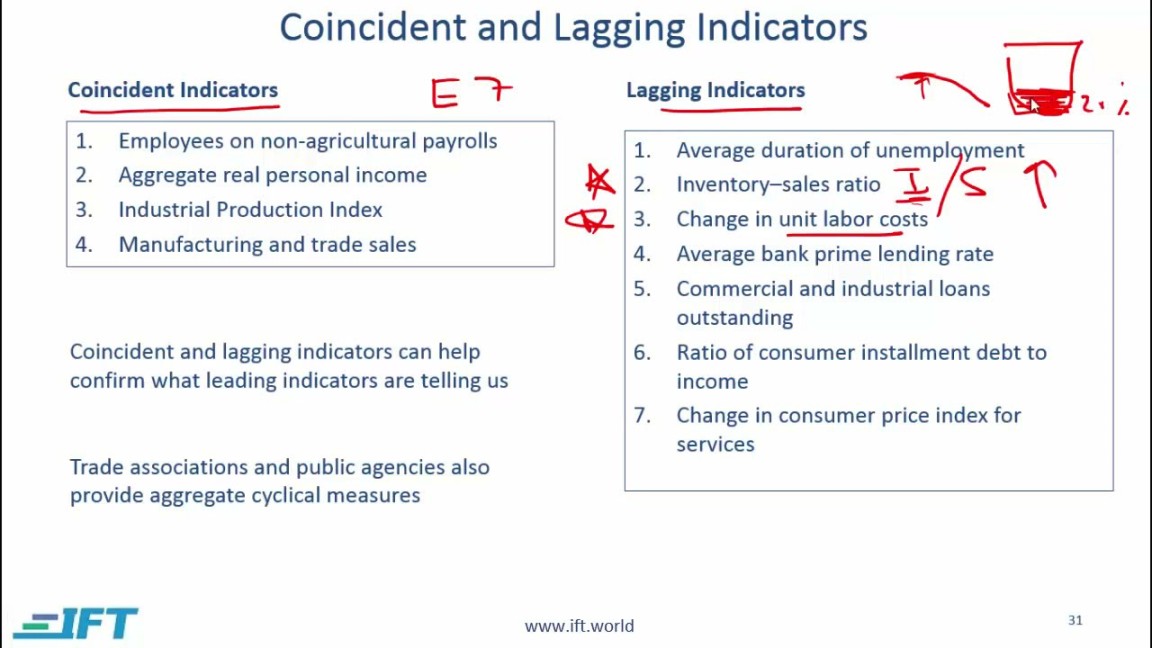

Coincident economic indicators, also known as concurrent indicators, are a class of economic data that reflect the current state of the economy. These indicators capture economic activity that is happening now, providing a snapshot of the economy’s performance at a given point in time. Unlike leading indicators, which attempt to forecast future economic trends, and lagging indicators, which reflect past economic conditions, coincident indicators offer a direct gauge of the economy’s current health.

Unveiling the Significance of Coincident Economic Indicators

Coincident economic indicators hold immense significance for various stakeholders in the economy. For businesses, these indicators provide valuable insights into current demand conditions, enabling them to make informed production, investment, and hiring decisions. Policymakers utilize coincident indicators to assess the effectiveness of their economic policies and make timely adjustments as needed. Individuals, on the other hand, can use coincident indicators to gauge their financial well-being and make informed consumption and savings decisions.

Delving into Commonly Used Coincident Economic Indicators

A diverse array of coincident economic indicators exists, each providing a unique perspective on the economy’s current performance. Some of the most widely used coincident indicators include:

Acknowledging the Limitations of Coincident Economic Indicators

While coincident economic indicators provide valuable insights into the current state of the economy, it is crucial to acknowledge their limitations. Firstly, coincident indicators are backward-looking, reflecting economic activity that has already occurred. This can make them less effective for anticipating future economic trends. Secondly, coincident indicators can be influenced by various factors beyond the underlying economic health, such as seasonal patterns and statistical revisions.

Embracing Real-World Applications of Coincident Economic Indicators

Coincident economic indicators find widespread application in various domains. Businesses utilize coincident indicators to gauge market demand, assess production needs, and make informed investment decisions. Policymakers employ coincident indicators to monitor the effectiveness of economic policies, identify potential economic imbalances, and implement timely policy adjustments. Individuals rely on coincident indicators to evaluate their financial well-being, make informed consumption choices, and plan for the future.

Conclusion: Unveiling the Economic Landscape with Coincident Indicators

Coincident economic indicators serve as a compass, guiding businesses, policymakers, and individuals through the complexities of the current economic landscape. By understanding the definition, significance, commonly used indicators, limitations, and real-world applications of coincident indicators, stakeholders can make informed decisions that contribute to a thriving economy.

Frequently Asked Questions (FAQs)

Coincident economic indicators reflect the current state of the economy, leading indicators attempt to forecast future economic trends, and lagging indicators reflect past economic conditions.

Coincident indicators are backward-looking and can be influenced by factors beyond the underlying economic health.

Businesses can use coincident indicators to gauge market demand,