Capital Asset Pricing Model (CAPM): A Comprehensive Guide

Introduction

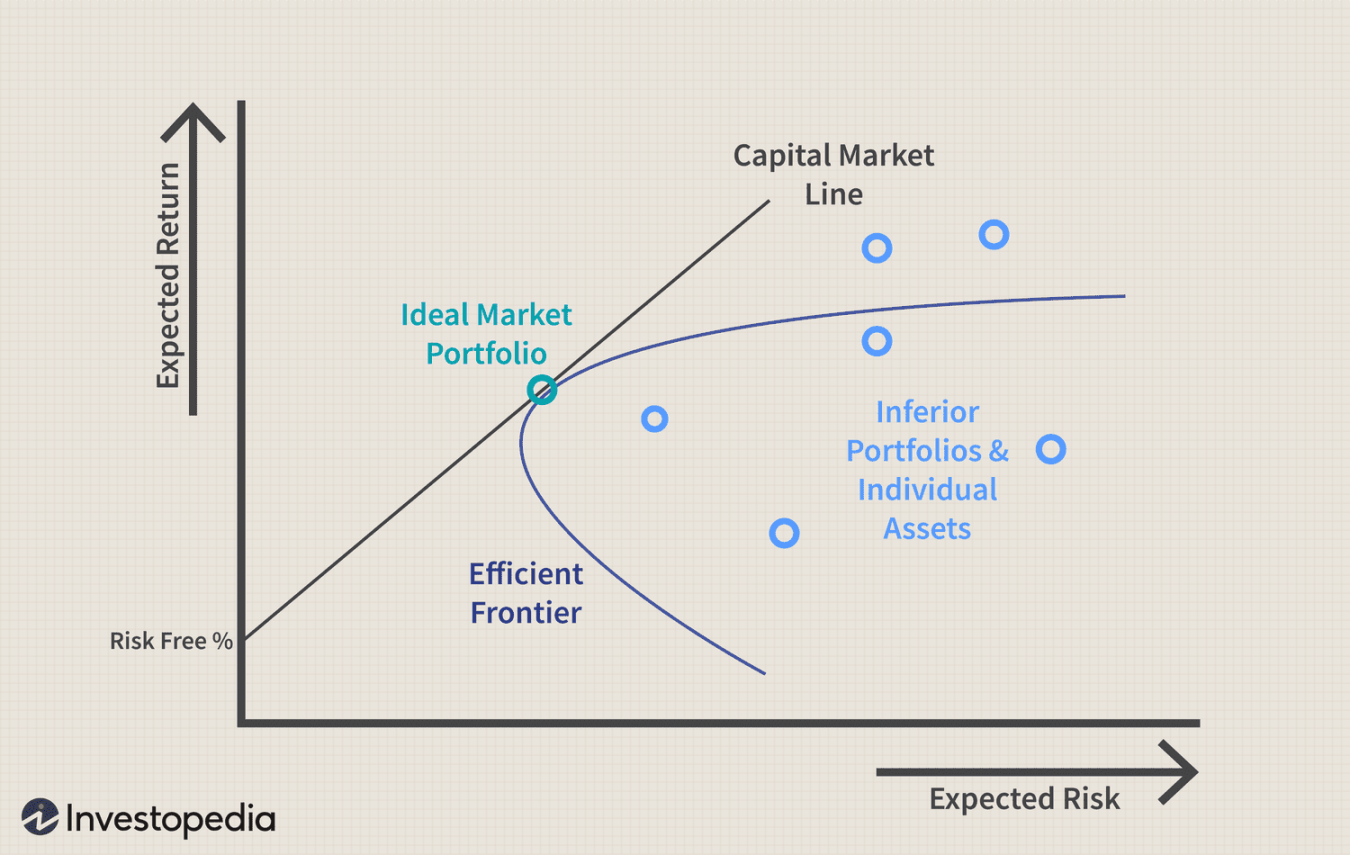

In the realm of finance, the Capital Asset Pricing Model (CAPM) stands as a cornerstone concept, providing a framework for understanding the relationship between risk and expected return on investments. This widely used model has gained prominence among investors, portfolio managers, and financial analysts alike, serving as a benchmark for evaluating investment decisions.

Understanding the Essence of CAPM

At its core, CAPM establishes a linear relationship between an asset’s expected return and its associated risk. It posits that investors demand a higher return for bearing greater risk, a principle that forms the foundation of the model.

Deconstructing the CAPM Formula

The CAPM formula, expressed as:

“`

Expected Return = Risk-Free Rate + Beta Equity Risk Premium

“`

breaks down the expected return into two distinct components:

1. Risk-Free Rate: This represents the return an investor can earn on a risk-free investment, such as government bonds. It serves as the baseline return against which riskier investments are compared.

2. Beta (β): Beta measures an asset’s sensitivity to the overall market’s movements. A beta greater than 1 indicates that the asset’s returns tend to amplify the market’s movements, while a beta less than 1 suggests that the asset’s returns are less volatile than the market.

3. Equity Risk Premium (ERP): This represents the additional return that investors expect for bearing equity risk, the risk associated with investing in stocks. It is calculated as the difference between the expected return on the market and the risk-free rate.

Interpreting the CAPM Formula

The CAPM formula highlights that an asset’s expected return is determined by two factors: its risk-free counterpart and its sensitivity to market movements. Investors demand a higher expected return for assets with higher betas, as these assets are considered riskier.

Practical Applications of CAPM

CAPM finds extensive applications in various financial domains, including:

1. Investment Analysis: CAPM serves as a tool for evaluating the expected return of potential investments, allowing investors to make informed decisions based on risk assessment.

2. Portfolio Management: Portfolio managers utilize CAPM to construct well-diversified portfolios that align with investors’ risk tolerance and return objectives.

3. Cost of Capital Estimation: Businesses employ CAPM to estimate their cost of equity, a crucial component in determining their overall cost of capital.

Limitations of CAPM

Despite its widespread use, CAPM is not without its limitations:

1. Assumption of Market Efficiency: CAPM assumes that markets are perfectly efficient, an oversimplification that may not hold true in real-world scenarios.

2. Beta Estimation Challenges: Accurately measuring an asset’s beta can be challenging, as it requires historical data and may not accurately reflect future risk.

3. Disregard for Unsystematic Risk: CAPM focuses solely on systematic risk, overlooking unsystematic risk, which can be diversified away through portfolio construction.

Addressing CAPM’s Limitations

To address these limitations, practitioners often employ refined CAPM models or consider alternative valuation methods in conjunction with CAPM.

Conclusion

The Capital Asset Pricing Model (CAPM) stands as a fundamental concept in finance, providing a framework for understanding the relationship between risk and expected return. Despite its limitations, CAPM remains a valuable tool for investment analysis, portfolio management, and cost of capital estimation. As investors and financial professionals navigate the complexities of the financial landscape, CAPM continues to serve as a guiding principle in making informed investment decisions.

Frequently Asked Questions (FAQs)

1. What is the difference between systematic and unsystematic risk?

Systematic risk, also known as market risk, affects all investments within a market due to broad economic factors or market-wide events. Unsystematic risk, on the other hand, is specific to a particular company or industry and can be diversified away through portfolio construction.

2. How do I calculate the equity risk premium (ERP)?

ERP is typically estimated based on historical market returns and risk-free rates. A common approach involves using the average market return over a long period, such as 10 years, and subtracting the average risk-free rate over the same period.

3. What are some alternative valuation methods to CAPM?

Alternative valuation methods include the Dividend Discount Model (DDM), which focuses on a company’s dividend-paying capacity, and the Earnings Multiple Approach, which values a company based on its earnings relative to similar companies.

4. How can I incorporate CAPM into my investment strategy?

CAPM can guide investment decisions by helping investors identify assets that align with their risk tolerance and return objectives. Investors can use CAPM to compare the expected returns of different assets and construct diversified portfolios that meet their investment goals.

5