Currency Swaps: A Comprehensive Guide

What are Currency Swaps?

In the realm of international finance, currency swaps emerge as a sophisticated financial instrument that facilitates the exchange of principal and interest payments between two parties in different currencies. These agreements, typically customized to suit the specific needs of the counterparties, involve a series of future cash flows denominated in the agreed-upon currencies.

1. Principal Exchange: At the inception of the swap, an initial exchange of principal amounts occurs, with each party transferring funds to the other in their respective currencies.

2. Periodic Payments: Throughout the swap’s tenor, a series of periodic payments are made, encompassing both interest and, in some cases, a notional principal amount.

3. Customized Terms: Currency swaps are tailored to the specific requirements of the parties involved, encompassing factors such as swap duration, payment frequencies, and interest rate conventions.

How Currency Swaps Work

The mechanics of currency swaps can be intricate, involving the exchange of both principal and interest payments over a predetermined timeframe. Let’s delve into the process:

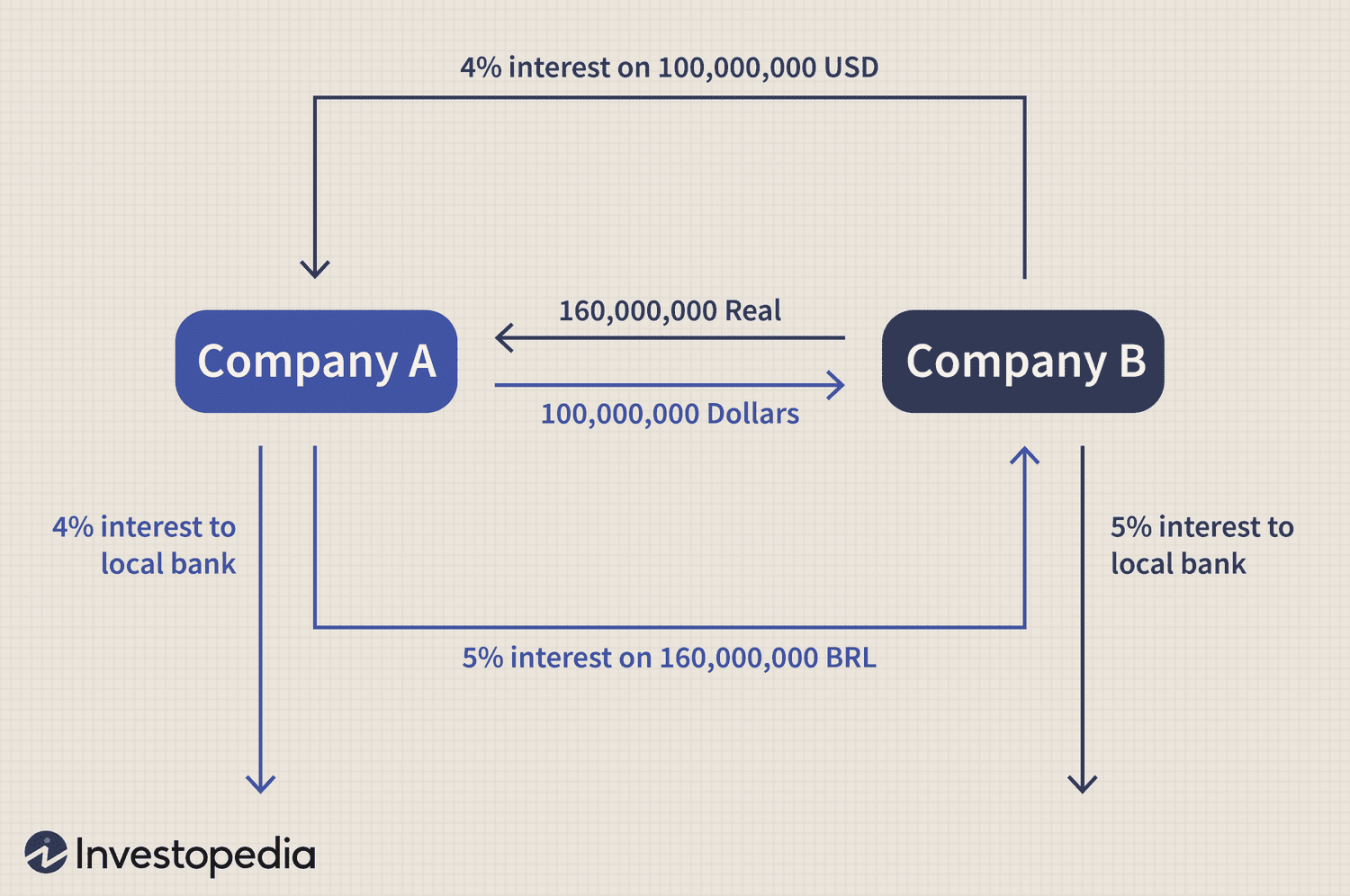

1. Contract Initiation: The swap agreement is established between two counterparties, outlining the terms and conditions of the exchange, including the currencies involved, swap tenor, payment frequencies, and interest rate conventions.

2. Principal Exchange: At the swap’s inception, an initial exchange of principal amounts takes place. Each party transfers funds to the other in their respective currencies, as agreed upon in the contract.

3. Periodic Payments: Throughout the swap’s duration, a series of periodic payments are made. These payments typically consist of two components:

a. Interest Payments: Each party makes interest payments to the other based on a predetermined interest rate calculation, applied to the notional principal amount. The interest rate conventions employed may be fixed or floating, depending on the agreement.

b. Notional Principal Exchange (Optional): In some currency swaps, a notional principal exchange occurs at predetermined intervals, effectively returning a portion of the original principal amounts to the respective parties.

4. Swap Termination: Upon reaching the swap’s maturity date, the final scheduled payments are exchanged, and any outstanding principal amounts are settled, concluding the swap transaction.

Understanding the Purpose of Currency Swaps

Currency swaps serve a multitude of purposes in the dynamic world of international finance. Let’s explore some of the primary motivations behind their usage:

1. Hedging Exchange Rate Risk: Currency swaps are commonly employed to hedge against potential exchange rate fluctuations. By locking in exchange rates for future cash flows, businesses and investors can mitigate the adverse financial impact of unfavorable currency movements.

2. Managing Funding Costs: Currency swaps can be utilized to optimize funding costs by converting debt obligations from one currency to another. This strategy can be particularly beneficial for entities with operations or revenue streams in multiple currencies.

3. Speculating on Exchange Rates: While not their primary purpose, currency swaps can also be used for speculative purposes. Traders may enter into swaps with the anticipation of profiting from favorable exchange rate movements.

Applications of Currency Swaps

Currency swaps find their application across a diverse spectrum of financial scenarios, catering to the needs of various market participants. Let’s examine some common use cases:

1. Corporations with Multinational Operations: Companies with operations or revenue streams denominated in multiple currencies can utilize currency swaps to manage their exposure to exchange rate risk and optimize their funding costs.

2. Investors with Global Asset Portfolios: Investors managing diversified portfolios across different currencies may employ currency swaps to hedge against exchange rate fluctuations and enhance their overall portfolio risk management strategies.

3. Financial Institutions: Banks and other financial institutions leverage currency swaps to facilitate international transactions, manage their own foreign exchange exposures, and offer hedging products to their clients.

Benefits of Currency Swaps

Currency swaps offer a range of potential benefits to their participants, including:

1. Exchange Rate Risk Mitigation: By locking in exchange rates for future cash flows, currency swaps can effectively shield parties from the adverse effects of unfavorable currency movements.

2. Optimized Funding Costs: Currency swaps can be instrumental in reducing funding costs by converting debt obligations from one currency to another, particularly advantageous for entities with operations or revenue streams in multiple currencies.

3. Tailored Risk Management: The customizable nature of currency swaps allows for tailored risk management strategies, catering to the specific needs and risk tolerance of each counterparty.

4. Enhanced Access to Global Markets: Currency swaps can facilitate access to global markets by enabling entities to borrow or invest in currencies other than their own.