Construction Project Funding: A Comprehensive Guide

Introduction

Construction projects are often complex and expensive undertakings, requiring significant financial resources to complete. Securing adequate funding is crucial for the success of any construction project, ensuring that all necessary materials, labor, and equipment are available throughout the project lifecycle. This comprehensive guide delves into the world of construction project funding, exploring its meaning, various types, funding processes, and available sources.

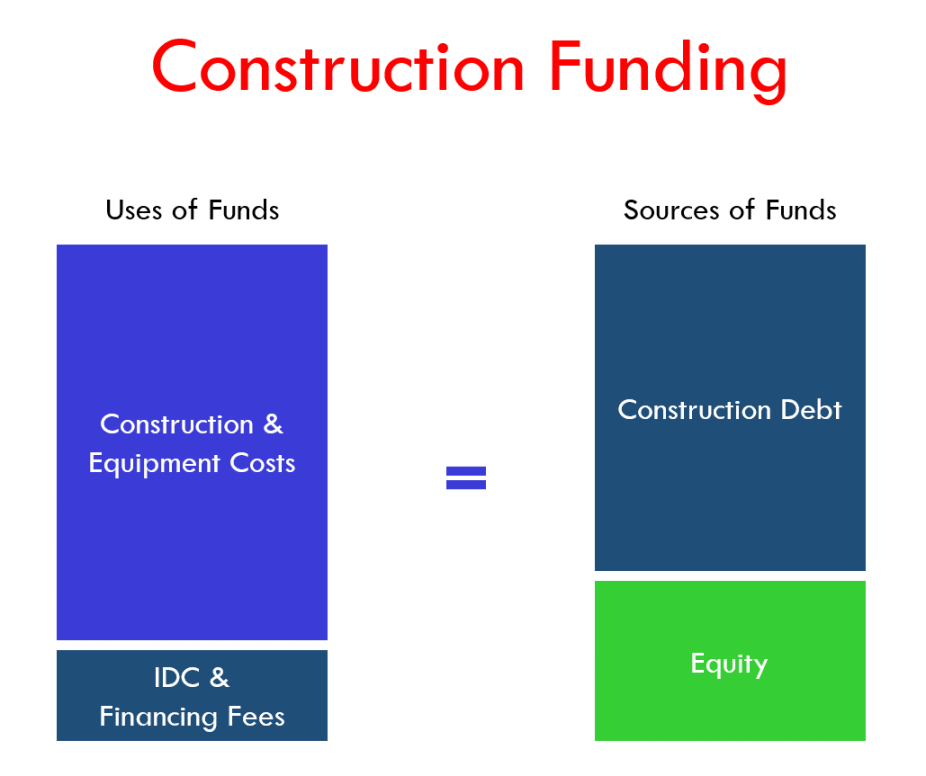

What is Construction Project Funding?

Construction project funding refers to the process of obtaining the financial resources required to initiate, execute, and complete a construction project. It encompasses securing funds from various sources, such as loans, equity investments, grants, and government subsidies, to cover the project’s expenses. Effective construction project funding involves careful planning, budgeting, and financial management to ensure that funds are available when needed and utilized efficiently.

Types of Construction Project Funding

Debt financing is the most common form of construction project funding, involving borrowing money from lenders, typically banks or financial institutions, in exchange for interest payments. Debt financing options include:

Equity financing involves raising capital by selling ownership shares in the project or the company undertaking the project. Investors who provide equity financing become part owners of the project and share in its profits or losses.

Hybrid financing combines debt and equity financing, offering a balance between the benefits of both. It can involve mezzanine financing, where investors provide debt-like financing with some equity features, or preferred equity, which grants investors priority over common shareholders in terms of dividend payments and asset distribution.

The Construction Project Funding Process

The construction project funding process typically involves the following steps:

Develop a detailed project plan outlining the project scope, schedule, and budget. The budget should accurately estimate all project costs, including materials, labor, equipment, and financing expenses.

Conduct a thorough financial analysis to assess the project’s viability and determine the total funding requirement. This includes evaluating the project’s revenue potential, profitability, and risks.

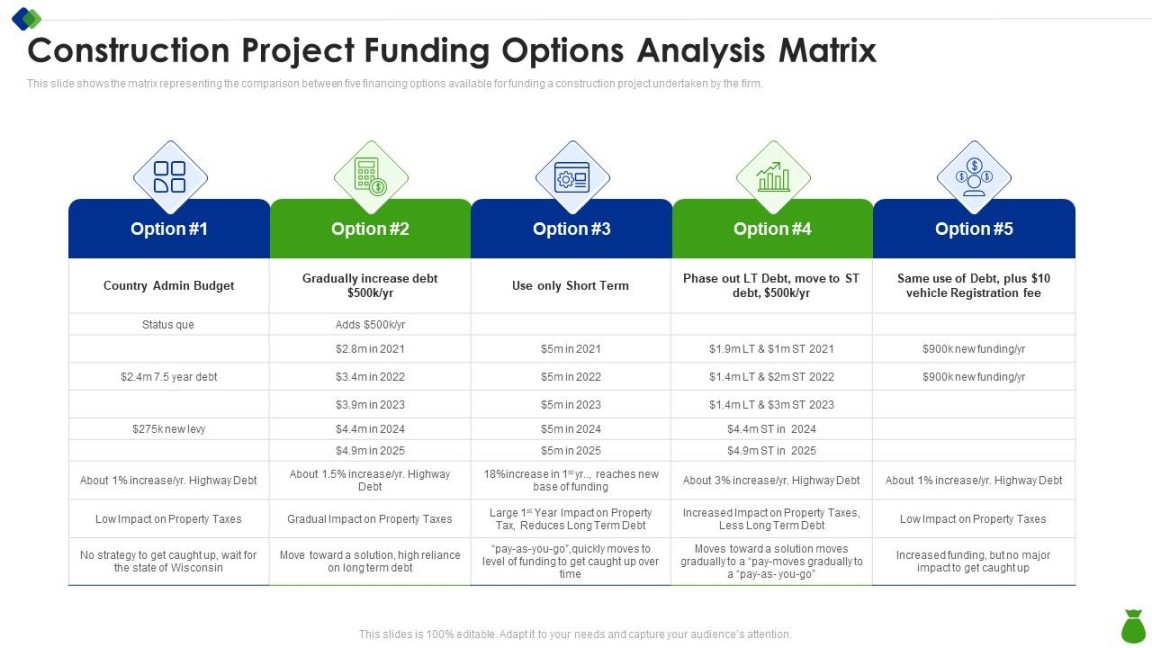

Create a funding strategy that outlines the mix of funding sources to be utilized. Consider the project’s characteristics, risk profile, and financing options available.

Prepare and submit funding applications to potential lenders or investors. Applications typically include detailed project information, financial projections, and risk assessments.

Negotiate the terms and conditions of financing agreements, including interest rates, repayment schedules, and collateral requirements. Upon reaching an agreement, finalize the financing arrangements.

Sources of Construction Project Funding

Commercial banks, credit unions, and other traditional lenders offer construction loans and term loans to qualified borrowers.

Government agencies may provide grants, loans, or tax incentives for construction projects that align with specific objectives, such as infrastructure development or affordable housing.

Private equity and venture capital firms invest in construction projects with high growth potential, often seeking equity stakes in return for funding.

REITs specialize in investing in real estate projects, including construction financing. They offer investors access to real estate investments through publicly traded shares.

Alternative lenders, such as crowdfunding platforms and peer-to-peer lending networks, provide funding options for projects that may not meet traditional lender criteria.

Factors Affecting Construction Project Funding

The project’s scope, complexity, location, and potential risks influence the funding options and terms available.

The borrower’s credit history, financial stability, and ability to repay the loan are crucial factors in securing funding.

Economic conditions, interest rates, and the availability of capital in the market impact the availability and terms of construction financing.

Compliance with building codes,