Taxation Policies: A Comprehensive Guide

Taxation Policies: Understanding the Foundation of Fiscal Systems

Taxation policies are the cornerstone of a nation’s fiscal system, encompassing the rules and regulations that govern the imposition of taxes on individuals, businesses, and entities within a country. These policies play a crucial role in shaping economic behavior, influencing resource allocation, and generating revenue for the government to fund public services and infrastructure.

Purpose of Taxation Policies

Taxation policies serve a multitude of purposes, extending beyond the mere collection of revenue. They are designed to:

1. Generate Revenue: The primary objective of taxation policies is to generate revenue for the government to finance its operations and provide essential public services such as education, healthcare, defense, and infrastructure.

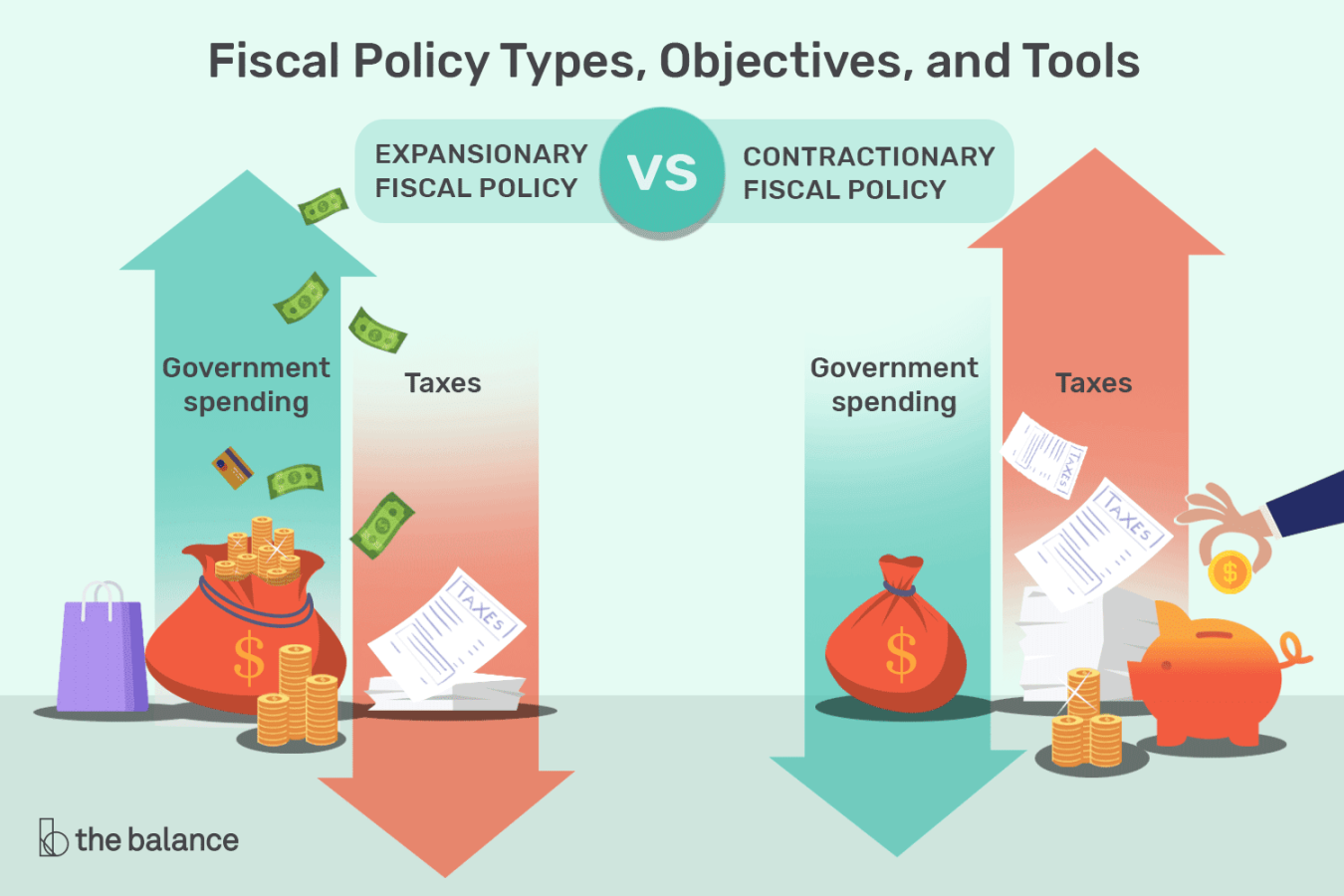

2. Promote Economic Stability: Taxation policies can be used to stabilize the economy by influencing aggregate demand and consumption patterns. Fiscal tools like tax cuts or tax increases can be employed to stimulate or moderate economic activity during periods of recession or inflation, respectively.

3. Encourage Social Equity: Taxation policies can be structured to promote social equity by redistributing wealth and supporting vulnerable populations. Progressive tax systems, where higher earners pay a larger share of their income in taxes, are commonly used to achieve this goal.

4. Steer Economic Behavior: Taxation policies can influence economic behavior by incentivizing or discouraging certain activities. For instance, tax breaks for investments in renewable energy can promote environmental sustainability, while taxes on tobacco or sugary drinks aim to discourage harmful consumption habits.

Implementation of Taxation Policies

The implementation of taxation policies involves a complex interplay between various stakeholders, including:

1. Government: The government, through its legislative and executive branches, is responsible for formulating, enacting, and enforcing taxation policies.

2. Tax Authorities: Tax authorities, such as the Internal Revenue Service (IRS) in the United States, are tasked with administering tax laws, collecting taxes, and ensuring compliance by taxpayers.

3. Taxpayers: Individuals, businesses, and entities subject to taxation are responsible for fulfilling their tax obligations by accurately reporting their income, filing tax returns, and paying taxes due.

Implications of Taxation Policies

Taxation policies have far-reaching implications for individuals, businesses, and the economy as a whole. These implications include:

1. Economic Effects: Taxation policies can significantly impact economic activity, influencing production, consumption, investment, and employment levels.

2. Distributional Effects: Taxation policies can affect the distribution of income and wealth within a society, potentially widening or narrowing income gaps.

3. Behavioral Effects: Taxation policies can influence individual and business behavior, incentivizing certain actions and discouraging others.

4. Compliance Costs: The complexity of taxation policies can impose compliance costs on taxpayers, particularly businesses, diverting resources from productive activities.

Solutions for Effective Tax Management

Effective tax management involves a combination of strategies aimed at minimizing tax liabilities while complying with all applicable tax laws and regulations. Common approaches include:

1. Tax Planning: Tax planning involves proactive measures to structure financial affairs in a way that minimizes tax liabilities within the legal framework. This may involve strategies such as choosing the appropriate business structure, maximizing deductions and credits, and deferring taxable income.

2. Tax Compliance: Tax compliance is the cornerstone of effective tax management, ensuring that all tax obligations are met accurately and timely. This involves maintaining proper tax records, filing accurate tax returns, and paying taxes due by the prescribed deadlines.

3. Seeking Professional Guidance: Complex tax matters often necessitate the expertise of tax professionals, such as certified public accountants (CPAs) or tax attorneys. These professionals can provide tailored advice and assist in navigating the intricacies of tax laws and regulations.

Information and Resources for Understanding Taxation Policies

A wealth of information and resources is available to help individuals and businesses understand taxation policies and navigate their tax obligations. These include:

1. Government Websites: Government websites, such as those of tax authorities, often provide comprehensive information on tax laws, regulations, forms, and guidance materials.

2. Tax Professionals: Tax professionals, such as CPAs and tax attorneys, can provide expert advice and assistance on tax matters.

3. Tax Software: Tax preparation software can simplify the process of filing tax returns and ensure accuracy.

4. Educational Resources: Educational resources, such as online courses, seminars, and workshops, can enhance understanding of taxation concepts and practices.

Conclusion

Taxation policies form the bedrock of a nation’s fiscal system, shaping economic behavior, influencing resource allocation, and generating revenue for public services. Understanding the purpose, implementation, implications, and solutions related to taxation policies is essential for individuals, businesses, and policymakers alike. By effectively managing tax