Risk Management Techniques: Identifying, Assessing, and Mitigating Risks

Introduction

In today’s dynamic and ever-changing world, organizations and individuals face a multitude of risks that can threaten their objectives, reputation, and financial stability. Risk management is a crucial process that helps identify, assess, and mitigate these risks, enabling proactive decision-making and enhancing resilience. This article delves into the world of risk management techniques, providing a comprehensive overview of various approaches and their applications.

Understanding Risk Management Techniques

Risk management techniques encompass a range of strategies and methodologies employed to identify, analyze, and address potential risks. These techniques aim to reduce the likelihood of adverse events occurring and minimize their impact if they do materialize. Effective risk management techniques are essential for businesses to safeguard their assets, protect their reputation, and achieve their strategic goals.

Key Risk Management Techniques

1. Risk Identification: The first step in risk management is to identify potential risks that could impact the organization or individual. This involves brainstorming, analyzing historical data, and conducting risk assessments.

2. Risk Assessment: Once risks have been identified, they need to be assessed in terms of their likelihood of occurrence and potential impact. This involves evaluating the probability and severity of each risk.

3. Risk Prioritization: Not all risks are created equal. Some pose a greater threat than others. Risk prioritization involves ranking risks based on their likelihood and impact, allowing for focused attention on the most critical risks.

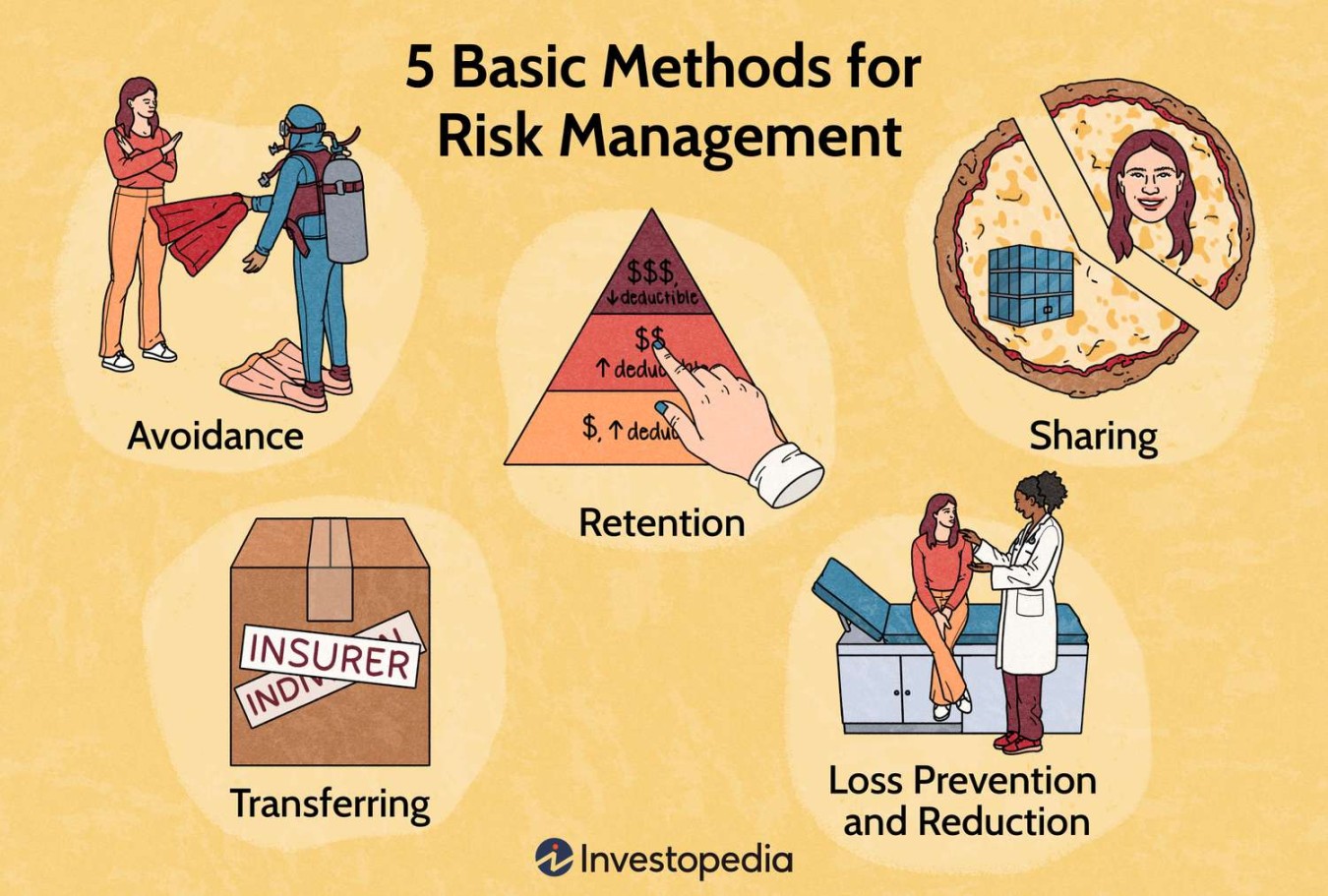

4. Risk Response Strategies: For each identified risk, a response strategy should be developed. This could involve risk avoidance, risk reduction, risk transfer, or risk retention.

5. Risk Monitoring and Review: Risk management is not a one-time event. It is an ongoing process that requires continuous monitoring and review. Regularly reviewing risks and updating response strategies ensures that the organization or individual remains proactive and adaptable.

Common Risk Management Techniques

1. Risk Avoidance: This involves eliminating the source of the risk altogether. For example, a company might avoid investing in a new product if it identifies significant market risks.

2. Risk Reduction: This involves implementing measures to reduce the likelihood or impact of a risk. For instance, a company might invest in cybersecurity training to reduce the risk of data breaches.

3. Risk Transfer: This involves shifting the risk to another party, such as through insurance or outsourcing. For example, a company might purchase insurance to protect against property damage.

4. Risk Retention: This involves accepting the risk and setting aside funds to cover potential losses. For instance, a company might decide to self-insure against minor risks.

Selecting the Appropriate Risk Management Technique

The choice of risk management technique depends on various factors, including the nature of the risk, the organization’s risk appetite, and the available resources. A combination of techniques may be employed to address different risks effectively.

Benefits of Effective Risk Management

Effective risk management offers a multitude of benefits, including:

1. Reduced Risk of Adverse Events: By proactively identifying and addressing risks, organizations and individuals can minimize the likelihood of negative outcomes.

2. Improved Decision-Making: Risk management provides valuable insights that inform better decision-making, enabling informed choices and strategic planning.

3. Enhanced Resilience: Effective risk management strategies strengthen an organization’s or individual’s ability to withstand and recover from unexpected events.

4. Protected Reputation: By managing risks effectively, organizations can safeguard their reputation and maintain stakeholder trust.

5. Achieved Strategic Goals: Risk management contributes to achieving strategic goals by reducing uncertainty and enabling focused resource allocation.

Implementing Risk Management Techniques

Implementing risk management techniques requires a structured approach:

1. Establish a Risk Management Framework: Define the organization’s or individual’s risk management approach, including roles, responsibilities, and communication protocols.

2. Identify Risks: Conduct regular risk assessments to identify potential risks across various areas of operations.

3. Assess Risks: Evaluate the likelihood and impact of each identified risk using appropriate methods.

4. Prioritize Risks: Rank risks based on their severity and likelihood to determine the most critical risks.

5. Develop Response Strategies: For each prioritized risk, develop a response strategy that aligns with the organization’s or individual’s risk appetite.

6. Implement Response Strategies: Implement the developed risk response strategies, including training, policy changes, or technological solutions.

7. Monitor and Review: Continuously monitor the effectiveness of risk management activities and review response strategies as needed.

Conclusion

Risk management is an indispensable practice for organizations and individuals seeking to navigate the complexities of